interest rate differential break mortgage

By interest rate modification vhda mortgage

Mortgage Penalty Calculator - RateSupermarket.ca

Mortgage Penalty Calculator - Calculate different the mortgage penalty options: IRD (Interest Rate Differential) mortgage penalty vs 3 month's interest payment .

http://www.ratesupermarket.ca/mortgage/penalty_calculator/

Why are mortgage rates hitting record lows? - Business - CBC News

Jan 13, 2012 . Is it worth your while to try to break your current mortgage to get in on the new deals? . A fixed-rate mortgage features an interest rate that is fixed for a . the current mortgage rate, known as the interest rate differential penalty; .

http://www.cbc.ca/news/business/story/2012/01/13/f-mortgage-rates-record-low.html

interest rates car loans

Break Your Mortgage | General

One significant barrier to exit your mortgage is INTEREST RATE DIFFERENTIAL or IRD. IRD is a penalty that allows your disgruntled lender to charge you the .

http://www.morcandirect.com/General/break-your-mortgageRefinancing Your Home Mortgage. Is It Worth It?

This is the greater of three months interest or the interest rate differential (IRD), which . One interesting strategy is you are planning to break your mortgage is to .

http://www.moneysmartsblog.com/refinancing-your-mortgage-is-it-worth-it/What Is the Penalty for Breaking a Mortgage? | eHow.com

You have to pay either an interest penalty or an interest rate differential penalty when you break a mortgage. The bank calculates both rates and whichever .

http://www.ehow.com/facts_6848880_penalty-breaking-mortgage_.html- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

Mortgage refinancing: the interaction of break even period, taxes ...

Mortgage refinancing: the interaction of break even . Mortgage interest rates have also decreased. . interest-rate differential needed to justify refinancing.

http://www2.stetson.edu/fsr/abstracts/vol_16_num3_p197.PDF- $0 Fraud Liability plus automatic mobile and email fraud alerts

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

state disability insurance oakland ca

- Earn $100 Bonus Cash Back after you make $500 in purchases in your first 3 months

- 0% Intro APR for 12 months on balance transfers and 6 months on purchases

- 5% Cash Back on up to $1,500 spent at grocery stores and movie theaters from 4/1/12 - 6/30/12

ING DIRECT Canada: Mortgage Jargon Buster

Or you can break your mortgage and get a new term at today's interest rate . the interest rate differential or 3 months interest plus any applicable fees related to .

http://www.ingdirect.ca/en/mortgages/jargonbuster/index.html- Unlimited 1% Cash Back on all other purchases

- Up to an additional 10% Cash Back when you shop online at select merchants through Chase

- No annual fee and rewards never expire

payday loan yes com

Refinance Mortgage: How Much Interest Can You Save?

Jul 28, 2011 . To break your current mortgage after 2 years of payments and with 3 years remaining you would be charged an interest rate differential (IRD) .

http://www.boomerandecho.com/refinancing-your-mortgage-how-much-interest-can-you-save/Canadian Mortgage Rates: Variable vs. Fixed Mortgage Rates ...

Mar 5, 2012 . Providing information on Canadian mortgage rates and variable rates vs Fixed . The prepayment penalty for a variable rate mortgage (breaking the . a fixed rate mortgage is 3 month interest or IRD (interest rate differential) .

http://www.canquestmortgage.com/variable-rate-mortgages.phpIs the mystery of the Interest Rate Differential - Axiom Blog - Axiom ...

Mar 7, 2012 . Usually, the cost of breaking your mortgage is either three months' interest or the Interest Rate Differential (IRD) – whichever is greater. It's the .

http://www.axiommortgage.ca/frontblog/2012/03/07/137-is-the-mystery-of-the-interest-rate-differential-about-to-be-solved.html- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

Mortgage Refinancing Strategies

Feb 12, 2009 . 3 month-Interest Rate Differential Calculator – Excel Spreadsheet . The problem in breaking a mortgage is the penalty that lenders charge.

http://www.howtobesetforlife.com/ask-an-expert/mortgage-refinancing-strategies/- $0 Fraud Liability plus mobile and email fraud alert options

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate predictions 2008 mortgage

- Earn Cashback Bonus for your good credit management

CanadaMortgageNews.ca

You can still benefit from these historically low interest rates. . with Interest Rate Differential penalties for Fixed rates that vary depending . I'm sure the BIG SIX Banks will love to see you break your mortgage and pay their infamous penalties.

http://canadamortgagenews.ca/Mortgage Canada Articles

We have been breaking mortgages for years and have no doubt that we can . When you find yourself in a high interest rate fixed mortgage the task of . One significant barrier to exit your mortgage is INTEREST RATE DIFFERENTIAL or IRD.

http://www.morcandirectcanada.com/mortgage-info/mortgage-articles?lang=en&start=5- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

Let's talk 7 and 10 year fixed mortgage rates… | Mortgage Superhero®

In Canada, when you break a fixed rate mortgage prior to maturity there is usually a penalty attached to this action. It is called an IRD, interest rate differential .

http://mortgagesuperhero.com/lets-talk-7-and-10-year-fixed-mortgage-rates/- $0 Fraud Liability plus mobile and email fraud alert options

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

employment agencies for mortgage industry

Breaking Your Mortgage Contract - What to Know

Mar 16, 2012 . Typically, when you break a mortgage, your lender will charge you the higher of your three months' interest or the IRD (interest rate differential).

http://www.homebasemortgages.ca/mortgage-news/should-you-break-your-mortgage/Canadian Mortgage Early Renewal Calculator: United Mortgage ...

Use this calulator to compare discounted mortgage rate offers, the costs or . the Interest Rate Differential and payout penalty on your mortgage. . Your cost to break this mortgage contract is $ 5219 (Greater of IRD and 3 month penalty) .

http://www.calculatorz.com/united/earlyrenew.cgi- No balance transfer fee for balances transferred in response to this online offer

- No Annual Fee

lake jackson credit repair

- Earn up to $120 in travel rewards--1,000 Bonus miles every month you make a purchase for the first year

- 1 Mile on every $1 you spend - Plus flexible redemption options like travel credits, merchandise, gift cards or cash

Fixed Rate Mortgage Exit Fees

Feb 8, 2009 . The actual cost of breaking a fixed rate mortgage varies significantly. . Basically, you are paying the whole interest rate differential up front to .

http://smartsearchfinance.com.au/blog/fixed-rate-mortgage-exit-fees/- No restrictions on travel--fly on any airline, book any hotel or car, with no blackout dates

- Travel benefits include secondary collision damage insurance when you rent a car with your Miles by Discover card

- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

student loan waiver for government employees

Breaking your mortgage: 'It's either worth it or it's not' | Refinancing ...

Mar 14, 2012 . When you cancel or break a mortgage you will be charged the greater of three months' interest or the Interest Rate Differential better known as .

http://business.financialpost.com/2012/03/14/breaking-your-mortgage-its-either-worth-it-or-its-not/- 2% automatically at gas stations and restaurants all year long*

Mortgage Wise

Feb 24, 2012 . The pre-approval may guarantee the interest rate for a mortgage taken . You may want to break the mortgage contract if you sell your home; if you . the greater of three months' interest, or the interest rate differential (IRD).

http://www.cba.ca/en/consumer-information/41-saving-investing/89-mortgages- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

TD Canada Trust - Mortgages - Glossary of Mortgage Terms

Interest Rate Differential Amount (IRD) - An IRD Amount is a prepayment charge that may apply if you pay off your mortgage principal prior to the maturity date or .

http://www.tdcanadatrust.com/products-services/banking/mortgages/glossary.jsp- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate on mortgages

- Earn up to $250 in travel rewards--1,000 Bonus miles every month you make a purchase for the first 25 months

- Double Miles on every $1 you spend

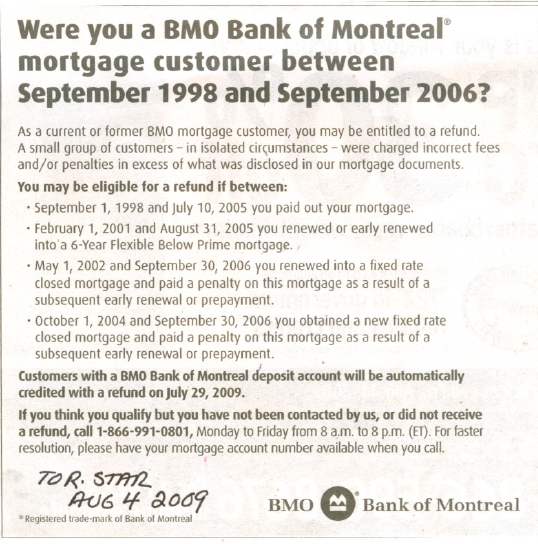

Were you a BMO Bank of Montreal Mortgage customer?

Were you a BMO Bank of Montreal Mortgage customer? . greater of the 3 month interest penalty or the IRD (Interest Rate Differential). . The bank is entitled to its interest equivalent and the borrower is entitled to the correct IRD fee to break a .

http://www.amortization.com/were_you_a_bmo_bank_of_montreal_mortgage_customer.htm- No restrictions on travel--fly on any airline, book any hotel or car, with no blackout dates

- Flexible redemption options like travel credits, merchandise, gift cards or cash

- Travel Insurance benefits, including primary car rental, lost or damaged luggage, travel delay, and trip cancellation when you book with your Escape by Discover card

- Discover is ranked #1 in customer loyalty--15 years in a row (2011 Brand Keys Customer Loyalty Engagement Index report)

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate federal student loan

winnipeg interest rate | Winnipeg's Best MortgageWinnipeg's Best ...

Feb 25, 2012 . 10 year mortgage rates, understanding the odds in your gamble . is 3 months interest payment and not Interest Rate Differential (IRD) like 1 . This will help you understand what your break even interest rate is in 5 years time.

http://www.winnipegmortgageinfo.com/category/winnipeg-interest-rate/Fixed Interest Rate Loan — The Mortgage Warehouse Ltd - Online ...

You can break your Weatpac fixed rate loan. However, depending on the interest rate differential related to Westpac's funding of your loan, you may need to .

https://www.mortgagewarehouse.co.nz/mortgages/westpac-home-loan/fixed-interest-rate-loan- Up to $50,000 limit

- No Annual Fee

- Cash Rewards credited each month

- No special restrictions to earn your cash rewards

TD Financial Group

But if you have a closed or fixed-rate mortgage, you will have to look . When you break your mortgage contract to renew your mortgage at a new rate and a new . months interest or the interest rate differential (that's the difference between .

http://www.teskey.com/mortgages/simpson1.htm

total of all american mortgages

- No annual membership fee

How much does it cost to break my mortgage before my term is over ...

Jan 18, 2011 . http://Propertysold.ca How much does it cost to break my mortgage . at 3%, you could be required to pay an interest rate differential penalty.

http://www.youtube.com/watch?v=7uRICr405nMThe Mortgage Centre Kitchener Waterloo | REFINANCE

There will often be a 3 month interest penalty or an IRD (interest rate differential) calculation for breaking your mortgage. The penalty can often be incorporated .

http://www.mortgagecentrekw.com/residential-mortgages/refinance/

interest rate mortgage last month

Canadian Mortgage Penalties | eHow.com

Interest Rate Differential. Under a closed mortgage, the bank locks in your interest rate for a predetermined period. If you pay off your mortgage early and break .

http://www.ehow.com/list_6728960_canadian-mortgage-penalties.htmlMichael James on Money: Gaming Mortgage-Breaking Costs

Nov 24, 2011 . Trying to break a mortgage before your term is up can be a . will ask for an " interest rate differential" (IRD), which is a mortgage-breaking fee.

http://michaeljamesmoney.blogspot.com/2011/11/gaming-mortgage-breaking-costs.html

interest rate for second mortgage

Fixed-rate Mortgage Penalties: Paging Mr. Flaherty | Dave The ...

To be clear, I am not against charging a penalty to mortgagors who break . be calculated as the greater of three-months interest or interest rate differential (IRD) . . Assume a $300000 mortgage with an interest rate of 5% that has two years .

http://www.integratedmortgageplanners.com/blog/buyer-beware/fixed-rate-mortgage-penalties-paging-mr-flaherty/Read before breaking your mortgage - The Globe and Mail

Mar 25, 2010 . The best way to find out the cost of breaking your mortgage is to use a . your mortgage, or an amount called the interest rate differential (IRD).

http://www.theglobeandmail.com/globe-investor/personal-finance/read-before-breaking-your-mortgage/article1511428/Zoocasa Real Estate Blog: Best money-saving mortgage tips

Feb 27, 2012 . Typically the penalty for breaking a mortgage is 3 months interest or the IRD ( Interest Rate Differential) - whichever is greater - and the lower .

http://blog.zoocasa.com/2012/02/best-money-saving-mortgage-tips.html-

Nova Scotia Real Estate | Your Local Real Estate Blog

Apr 6, 2012 . When you cancel or break a mortgage you will be charged the greater of three months' interest or the Interest Rate Differential better known as .

http://stevengiffin.wordpress.com/ - Online access to credit card account information

-

Pay down the mortgage? - mortgage finance interest | Ask MetaFilter

Nov 13, 2009 . If they break the mortgage, they would pay an interest rate differential of about $17k. They could refinance at around 4% fixed or 2.2% variable, .

http://ask.metafilter.com/138053/Pay-down-the-mortgage

When Should Borrowers Refinance Their Mortgages?

reduces to the choice of an optimal interest rate differential. At this opti- . offered a mortgage calculator based on a break-even calculation. Of those 80, 30 .

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.170.9784&rep=rep1&type=pdf

Should I Refinance My Home? | Bills.com: Find. Save. Learn.

Refinance | At what interest rate would it make sense for me to refinance my home? . table that helps you calculate the break-even point for a mortgage refinance. . left on your current mortgage, and the interest rate differential is not too large.

http://www.bills.com/should-i-refinance-my-home/

How to Save Money When Refinancing A Home Mortgage

If you *DO* decide to break your mortgage, there's an easy way you can save . method for calculating the penalty called the interest rate differential (IRD).

http://www.moneysmartsblog.com/how-to-save-money-when-breaking-a-mortgage/

Mortgage penalty can be a shocker - thestar.com

Mar 11, 2009 . A s interest rates fall to record lows, you may want to break your mortgage and negotiate a lower rate. But the penalty charges can be .

http://www.thestar.com/unassigned/article/600049--mortgage-penalty-can-be-a-shocker

You are signed up to receive the latest deals, offers and tips!

interest rate home mortgage

christian harbor credit debt free

insurance benefits for cancer patients

interest rate on private student loan

steven mintz mortgage new jersey

expere mortgage

interest rates and student loans

low cost health insurance in florida

home improvement sitcom merchandise

turbo tax 2006 mortgage interest wrong

interest rate goverment student loans