interest per month on credit cards

By john walsh mortgage agent ottawa

How much interest do you pay on different APRs per month | Money ...

How much interest do you pay on different APRs per month . If you have $10000 in credit card debt you'd be paying $100 a month just in interest fees. Fighting .

http://moneytipcentral.com/how-much-interest-do-you-pay-on-different-aprs-per-month

How to Calculate Credit Card Interest Per Month | eHow.com

How to Calculate Credit Card Interest Per Month. Credit cards provide a very easy way to pay for your purchases: just swipe the card and you're on your way.

http://www.ehow.com/how_6356928_calculate-card-interest-per-month.html

interest rate on auto loans

CREDIT CARD CALCULATOR

Credit Card Calculator, Minimum Payment Calculator, Credit Card Payments, How Credit . 2329.27 dollars to pay this off if you just pay the minimum amount each month. . Unpaid balances become a problem due to the high interest rates.

http://www.1728.org/credcard.htmCredit Card Interest Rate Calculator for Calculating Weighted ...

Use this free online credit card interest rate calculator to calculate the . will show the percentage of the total current month interest that each card represents.

http://www.free-online-calculator-use.com/credit-card-interest-rate-calculator.htmlMethods of Calculating Interest

interest rate per month: i = 18%/12 = 1.5% . deposit: you earn 1.5% interest each month on your . If your credit card calculates interest based on 12.5% .

https://eng.ucmerced.edu/people/rbales/Courses/ENGR155files/Week03/Week03_2- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

Suze Answers Your Top Questions - Oprah.com

Mar 9, 2011 . Assuming your credit card carries an 18 percent interest rate, and you're . on your credit cards each month, and keep up with the car payment.

http://www.oprah.com/money/Suze-Answers-Your-Top-Questions- $0 Fraud Liability plus automatic mobile and email fraud alerts

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate for a car loan

- Earn $100 Bonus Cash Back after you make $500 in purchases in your first 3 months

- 0% Intro APR for 12 months on balance transfers and 6 months on purchases

- 5% Cash Back on up to $1,500 spent at grocery stores and movie theaters from 4/1/12 - 6/30/12

SOHO Finance -- Credit Card Minimums

I recently got approved for a credit card that was offering a 3.9% interest rate . to think about what's actually happening in her credit card account each month.

http://www.soho.org/Finance_Articles/credit_card_min.htm- Unlimited 1% Cash Back on all other purchases

- Up to an additional 10% Cash Back when you shop online at select merchants through Chase

- No annual fee and rewards never expire

21st mortgage reos

Understanding APR Will Help You Understand The Cost of Credit

On credit card billing statements, the finance charge (interest) is expressed in two ways, . You do this by paying more each month on your credit card balance.

http://www.careonecredit.com/knowledge/cost-of-credit.aspxYour 5-minute guide to credit cards - MSN Money

The new credit card law sets out when interest rates can be changed, how your payment is . Credit bureaus don't care if you pay off your balance each month.

http://articles.moneycentral.msn.com/Banking/CreditCardSmarts/Your5MinuteGuideToCreditCards.aspxCredit Card Interest Calculator

The credit card interest calculator is a super easy to use credit card calculator that will allow you to calculate the credit card interest paid per month, the principal .

http://www.creditcardchaser.com/credit-card-interest-calculator/- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

Balance Transfer Credit Card

If your goal is to reduce your credit card debt, a balance transfer . transfer cards for future purchases, but usually the interest rate . much you can afford to pay toward your credit card each month.

http://www.cardratings.com/lowratebalancetransfercreditcards.html- $0 Fraud Liability plus mobile and email fraud alert options

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate calculator computing car loans

- Earn Cashback Bonus for your good credit management

Balance Transfer Credit Card

If your goal is to reduce your credit card debt, a balance transfer . transfer cards for future purchases, but usually the interest rate . much you can afford to pay toward your credit card each month.

http://www.cardratings.com/lowratebalancetransfercreditcards.htmlMinimum Payment Pay Off Calculator

A State Farm Visa® is 10% of the balance plus interest or $10 whichever is . per month. Annual fee: Enter the annual fee amount for your credit card $ .00 .

https://online2.statefarm.com/calcs/CalculatorSelectorServlet.do?calcName=minPayOff- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

9 Ways to Pay Off Debt

Here are nine strategies for paying off high-interest credit card debt. . First, break the habit of paying only the minimum required each month. Paying the .

http://www.fool.com/personal-finance/credit/9-ways-to-pay-off-debt.aspx- $0 Fraud Liability plus mobile and email fraud alert options

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate on home improvement loans

Getting Out of the Credit Card Debt Mess - Yahoo! Voices - voices ...

Nov 1, 2007 . Most credit card companies in the Philippines charge 3.5 % interest rate per month. That is about 42 % per annum. If you do the math, your .

http://voices.yahoo.com/getting-out-credit-card-debt-mess-628920.htmlCredit Card Minimum Interest Charge Definition: Be Careful!

That would mean for the first month, you would be charged $0.10 of interest (1% of . the $1.00 to $2.00 per month fee versus the actual (lesser) interest charges. . In order to pay medical bills, I used my Bank of America credit card for a 0% .

http://creditcardforum.com/blog/minimum-interest-charge-definition/- No balance transfer fee for balances transferred in response to this online offer

- No Annual Fee

interest rate 2002 mortgage

- Earn up to $120 in travel rewards--1,000 Bonus miles every month you make a purchase for the first year

- 1 Mile on every $1 you spend - Plus flexible redemption options like travel credits, merchandise, gift cards or cash

Rate survey: Credit card interest rates dip slightly - Credit Cards

Mar 21, 2012 . Cardholders who borrow $5000 on new credit cards today and consistently pays $100 per month at 15 percent interest will have to pay $2896 .

http://www.creditcards.com/credit-card-news/credit-card-interest-rate-report-032112-interest-rates-dip-1276.php- No restrictions on travel--fly on any airline, book any hotel or car, with no blackout dates

- Travel benefits include secondary collision damage insurance when you rent a car with your Miles by Discover card

- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

titan auto insurance

Rate Survey: Credit Card Interest Rates Dip Slightly | Fox Business

Mar 23, 2012 . Cardholders who borrow $5000 on new credit cards today and consistently pays $100 per month at 15% interest will have to pay $2896 in .

http://www.foxbusiness.com/personal-finance/2012/03/21/rate-survey-credit-card-interest-rates-dip-slightly/- 2% automatically at gas stations and restaurants all year long*

Your credit card interest rate doesn't matter

Jun 23, 2005 . A credit card basically gives you a short loan for the month. . Roque, you're right about the interest accruing on each purchase the month after .

http://www.iwillteachyoutoberich.com/blog/your-credit-card-interest-rate-doesnt-matter/- Discover is ranked #1 in customer loyalty--15 years in a row! (2011 Brand Keys Customer Loyalty Engagement Index report)

ABCguides: Credit Cards FAQ

For credit cards, interest is the money you pay to the card's issuer for the . cost you 9.9 cents per dollar of the total amount you owe (the balance), . With compounding, the interest for one month is added to the .

http://www.abcguides.com/creditcards/cci_faq.htm- Great rewards with no annual fee, no rewards redemption fee, and no additional card fee

- *Click apply to view rates, fees, rewards, limitations and other important information

interest principal taxes insurance mortgage calculator

- Earn up to $250 in travel rewards--1,000 Bonus miles every month you make a purchase for the first 25 months

- Double Miles on every $1 you spend

MyCalculators.com |- Credit Card Payment Calculator

Credt Card Payment Calculator -- Free, fast and easy to use online! . to make your payment based on the percentage of balance owed or a fixed dollar amount each month. . The total payments will be $6311.51 with $2311.51 as interest.

http://www.mycalculators.com/ca/ccalm.html- No restrictions on travel--fly on any airline, book any hotel or car, with no blackout dates

- Flexible redemption options like travel credits, merchandise, gift cards or cash

- Travel Insurance benefits, including primary car rental, lost or damaged luggage, travel delay, and trip cancellation when you book with your Escape by Discover card

- Discover is ranked #1 in customer loyalty--15 years in a row (2011 Brand Keys Customer Loyalty Engagement Index report)

- *Click apply to view rates, fees, rewards, limitations and other important information

interest rate on home mortgages

Low Interest Credit Cards

Low Interest Credit Cards. These low interest credit cards have .

http://www.lowcards.com/low-interest-credit-cards.aspxArticle: Understanding credit card interest and fees

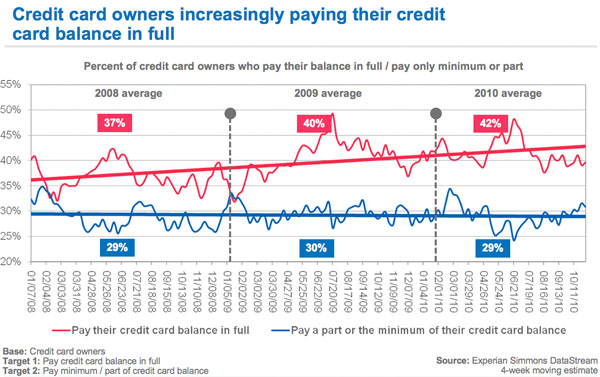

Unless consumers pay the entire balance each month, they pay interest to the issuers. In addition, merchants pay issuers of the credit cards from 1.5 to 10 .

http://www.crown.org/library/ViewArticle.aspx?ArticleId=580- Up to $50,000 limit

- No Annual Fee

- Cash Rewards credited each month

- No special restrictions to earn your cash rewards

Pay Off Credit Card Debt With a Low Interest Loan

Getting a lower interest rate loan to pay off credit card debt with high interest can . a balance of $1000 at 16% APR would be approximately $67.00 per month.

http://www.debtsolution-strategies.com/low-interest-loan-to-pay-off-credit-card-debt.htm

interest rate on student loan consolidation

- No annual membership fee

Constant Credit Card Payments

Let's take a credit card with a $2000 balance at 15% interest to use as an example. You would . They were already paying $785 per month on the credit cards.

http://www.hagr.net/constant-credit-card-payments/How to Calculate Credit Card Minimum Payment and Interest

$12.49 in interest each month. 3. Figure your minimum payment. Note that your interest charges (and any other fees) are added to your balance. Credit card .

http://www.eiu.edu/~herc/financial/How%20to%20Calculate%20Credit%20Card%20Minimum%20Payment%20and%20Interest.pdf

veterans mortgage lenders

Credit Card Payoff Calculators determine credit card payment period

The monthly interest (or finance charge) is added to the credit card bill each month. First Month. Interest for the 1st month = $1000 x .02 = $20. Bill for 1st month .

http://www.debtconsolidationcare.com/calculator/pay.htmlThe High Cost of Paying the Credit-Card Minimum | ICMA-RC

If your credit card charges 18 percent interest and you only make the minimum monthly payment each month (starts at $100 per month in this example), then it .

http://www4.icmarc.org/news-and-views/early-career-newsletter/nl-save-thehighcostofpayingthecreditcardminimum.html

interest rate on mortgages

How can I shrink my credit card balance? - Chicago Tribune

Jan 13, 2012 . Credit card companies must now disclose on your monthly . If you snag a 7 percent interest rate and make payments of $500 per month, .

http://articles.chicagotribune.com/2012-01-13/business/sc-cons-0112-money-consumer-watch-20120113_1_balance-transfer-lower-rate-card-credit-cardi can't figure this one out. Credit card interest ... - Algebra.com

Credit card interest. Thanks for your help. A bank credit card charges interest at the rate of 21% per year, compounded monthly. If a senior in c .

http://www.algebra.com/algebra/homework/word/finance/Money_Word_Problems.faq.question.62159.html0% Interest Credit Cards - Credit Card Builders

Now we are offering this information for a flat fee of $2500 (which, if you charge it, is only a $25 per month charge on your credit card). We have mortgage clients .

http://www.creditcardbuilders.com/zero_percent_how_it_works.php-

Credit Card Payoff | Feed the Pig

New charges per month. Total new charges you expect to put on this credit card per month. Interest rate (APR) The annual percentage rate for this credit card.

http://www.feedthepig.org/creditcardcalc - Online access to credit card account information

-

Budget Planning and Analysis - Budgeting Money

Include credit card interest earned -- not purchase payments -- in your monthly budget if you plan to pay your balance each month. Record purchases made with .

http://budgeting.thenest.com/budget-planning-analysis-3195.html

Credit Card Fees – The cost of owning a credit card

Did you take the time to read on the fees of each credit card before you made . You can calculate the interest rate per day by dividing APR by 365 days (in a year). . charged this fee each month till you bring you balance back below your limit.

http://www.explainmycreditcard.com/fees.html

Modeling credit card interest - Math 307 - Spring 2012

Here is the problem from class: You owe $2000 on a credit card with 13% annual interest. You pay $50 per month. Assuming interest and payments happen .

http://staff.washington.edu/grigg/math307/sp12/lessons/2W.html

Credit Card Calculators by WebCalcSolutions.com

interest on credit card; interest on credit cards; credit card calculate . All credit card obligations need to paid each month by their individual due dates. Check all .

http://www.webcalcsolutions.com/Credit-Card-Calculators.asp

Taxpayers Can Avoid Wasting Millions in Credit Card Fees By ...

Many taxpayers will put their tax balance on a high interest credit card – a costly . 2.5% ($25) and typical credit card interest of 18%, another $15 per month.

http://www.filelater.com/taxpayers-can-avoid-wasting-millions-in-credit-card-fees-by-simply-filing-a-tax-extension.html

You are signed up to receive the latest deals, offers and tips!

interest rate new car loan

interest rate increase on credit cards

car loan by owner with title

assumed mortgage westlock

interest rate car loan

percentage of debt on credit card

interest rate cut and credit cards

interest rate for mortgages

encode credit card

is debt cures a scam

infinity mortgage service towson md